Reduce Costs by 30%

-

Peak demand monitoring

-

Standby usage insights

-

Anomaly detection

Rhino is the global #1 in remote energy & utility monitoring, delivering accurate, reliable, and real-time insights for commercial real estate. Rhino helps real estate businesses of all sizes and types become more cost-efficient, sustainable, and fully compliant with regulations—empowering a greener and more efficient future.

Peak demand monitoring

Standby usage insights

Anomaly detection

Automated reporting

ESG-ready data for CSRD, SFDR

Building certification integrations

The Rhino API provides seamless integration capabilities, allowing you to incorporate real-time utility data into your existing systems effortlessly. Whether it's a property management tool, ESG dashboard, or a tenant engagement app, the Rhino API makes it easy to share, analyze, and act on energy insights.

Rhino collects utility data from diverse sources: direct APIs from utility providers, third-party software and hardware solutions, and our own proprietary Rhino Hardware, which reads over 250 types of smart and legacy meters.

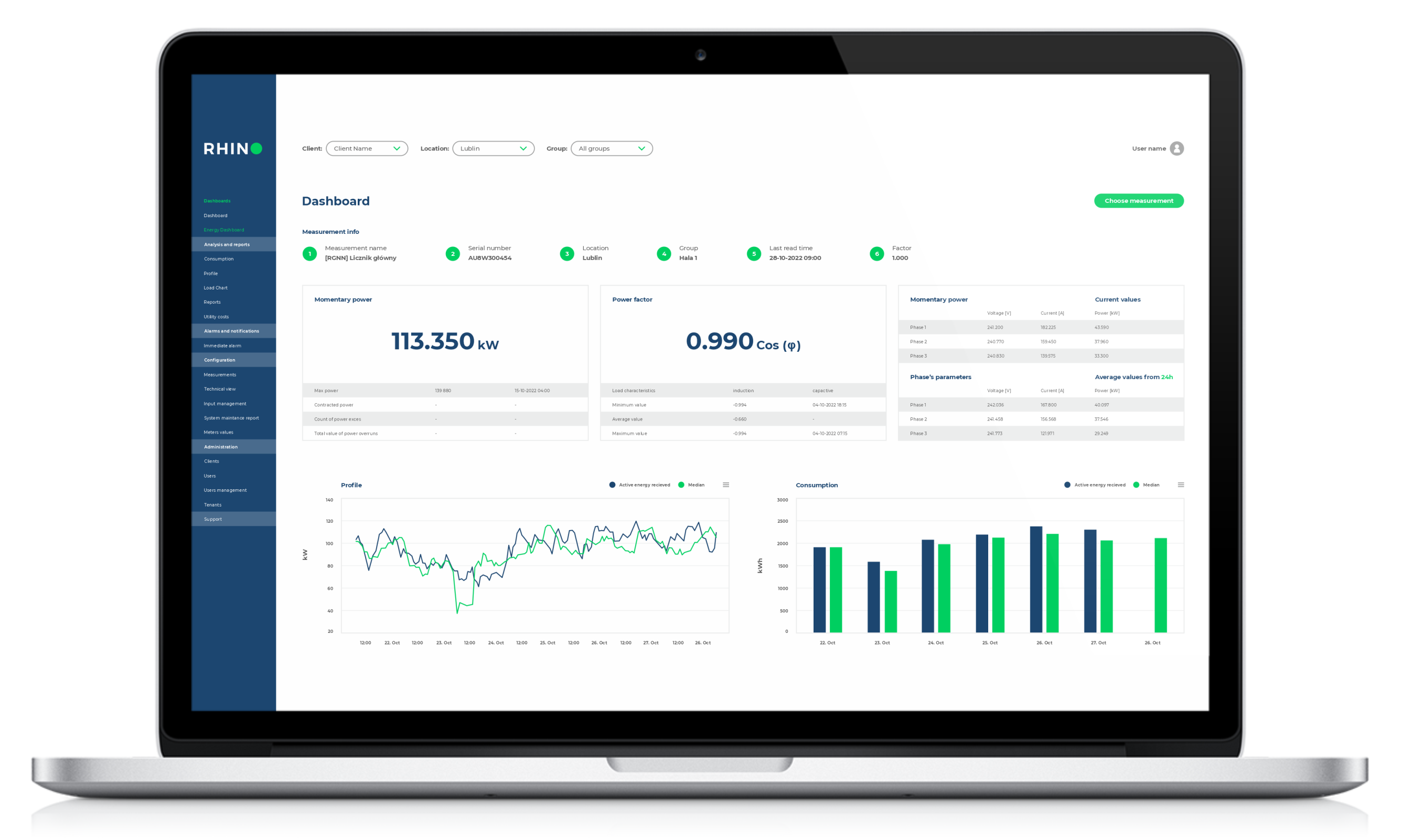

The Rhino Platform is your smart solution for monitoring, analyzing, and optimizing utility consumption. Gain real-time insights, receive instant alerts, and generate custom reports to maximize savings and reduce environmental impact.

With Rhino's real-time electricity monitoring, you stay in control of your energy use—minute by minute. Our live dashboard gives you a detailed view of building performance, helping you reduce costs, stay compliant, and eliminate waste.

With Rhino, you reduce consumption risks and mitigate hazards before they escalate—protecting people, property, and the planet.

Water waste is silent—but expensive. With Rhino's smart water monitoring, you gain full transparency over water consumption and get alerted instantly in case of unusual spikes or leaks.

With Rhino, you reduce consumption risks and mitigate hazards before they escalate—protecting people, property, and the planet.

Gas leaks are not only expensive—they're dangerous. Rhino provides robust, real-time gas monitoring with automated alerts to ensure safety, efficiency, and ESG compliance across your portfolio.

With Rhino, you reduce consumption risks and mitigate hazards before they escalate—protecting people, property, and the planet.