Reduce Costs by 30%

-

Peak demand monitoring

-

Standby usage insights

-

Anomaly detection

Rhino is the global #1 in remote energy & utility monitoring, delivering accurate, reliable, and real-time insights for commercial real estate. Rhino helps real estate businesses of all sizes and types become more cost-efficient, sustainable, and fully compliant with modern (ESG) regulations—empowering a greener and more efficient future.

Peak demand monitoring

Standby usage insights

Anomaly detection

Automated reporting

ESG-ready data for CSRD and SFDR

Building certification integrations

Alarms & notifications for leak detection

Submetering

Automated tenant billing

The Rhino API provides seamless integration capabilities, allowing you to incorporate real-time utility data into your existing systems effortlessly. Whether it's a property management tool, ESG dashboard, or a tenant engagement app, the Rhino API makes it easy to share, analyze, and act on energy insights.

Rhino collects utility data from diverse sources: direct APIs from utility providers, third-party software and hardware solutions, and our own proprietary Rhino Hardware, which reads over 250 types of smart and legacy meters.

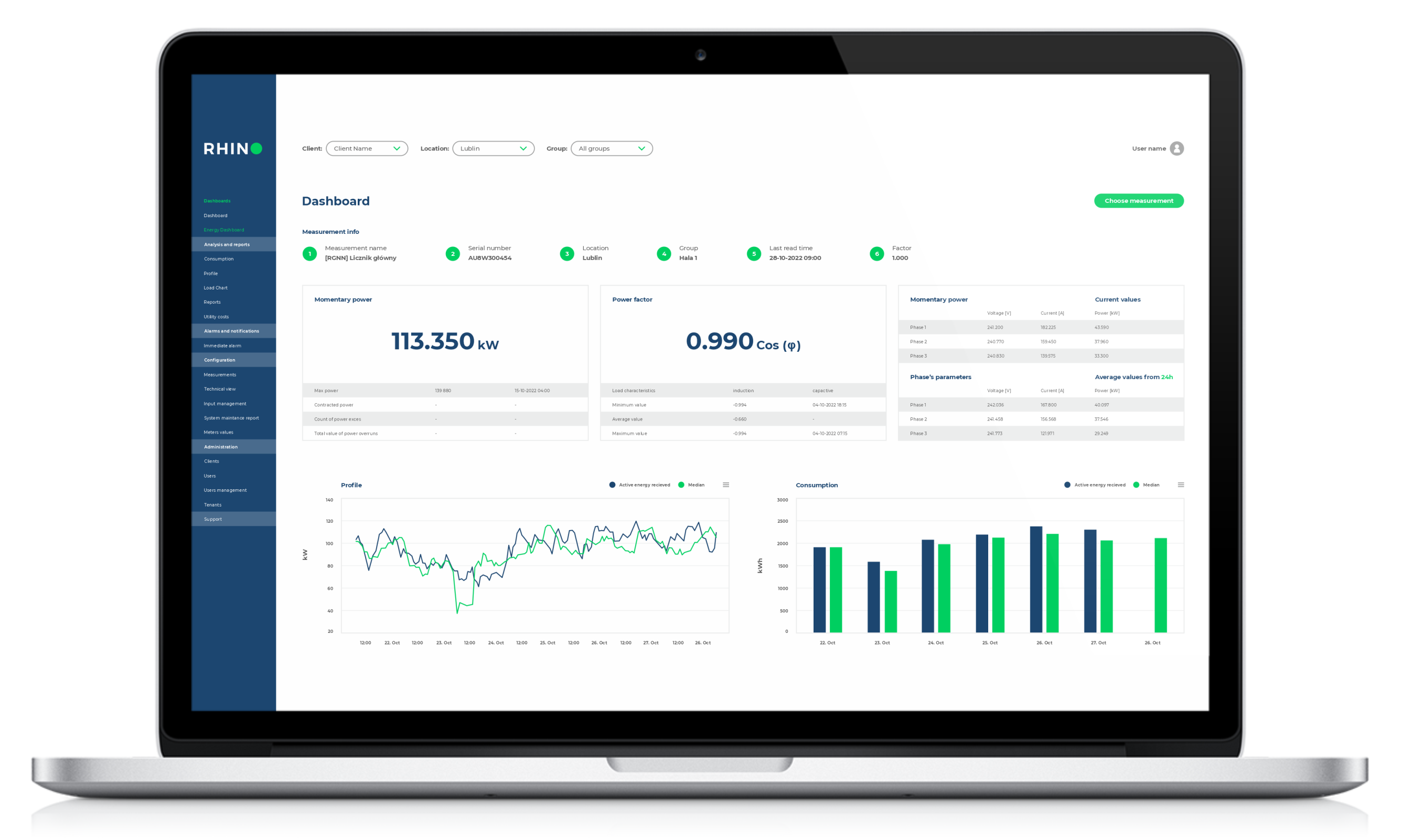

The Rhino Platform is your smart solution for monitoring, analyzing, and optimizing utility consumption. Gain real-time insights, receive instant alerts, and generate custom reports to maximize savings and reduce environmental impact.